- 63 Posts

- 183 Comments

Never. I won’t buy a game until I’ve tried it. If no demo is available, I’ll pirate it first, and then buy it later if its good.

7·12 days ago

7·12 days ago“fishy” = bacterial vaginosis

The common scent element in healthy cis women is “tangy”.

Estrogen causes the vaginal walls to secrete glycogen, which gets eaten by lactobacilli, which produce lactic acid.

Lack of tanginess can be caused by low estrogen levels. It tells us about your current endocrine ecology, not your gender identity.

2·14 days ago

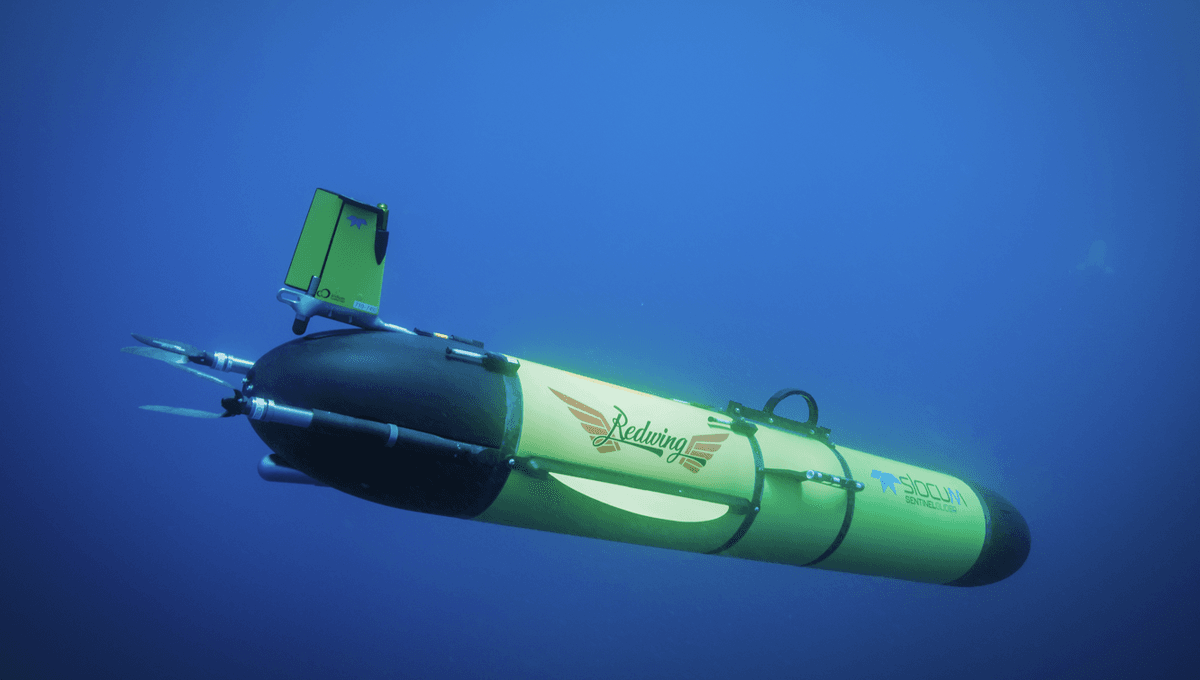

2·14 days agoYeah, the chemistry of the medium changes over time to contain more metals. I wonder how much, or how fast the chemistry of the accretion disk changes too?

27·14 days ago

27·14 days agocomms beep

Bridge: “Bridge to Jordi.”

comms beep

Jordi: “Jordi here, have you tried turning it off and on again?”

211·19 days ago

211·19 days agodeleted by creator

4·19 days ago

4·19 days agoSecond person is when you play a healer.

83·20 days ago

83·20 days agoEvery once in a while, declare sausage. It confuses the hell out of your enemies.

–Rule of Acquisition #76

3·20 days ago

3·20 days agoEven a broken clock is right twice a day, and the cons calling the Bureau of Labor Statistics useless was one example.

When a person can’t quickly find a new job, BLS just stops counting them as unemployed.

8·23 days ago

8·23 days agoI wouldn’t count on it anytime soon. The data center build out is a years long process, and even after they get built, their owners will want to use the initially installed hardware for as long as possible before upgrading.

Expect demand for new RAM to remain higher than it was before the AI datacenter build out began. Maybe not as high as it is right now, but some degree of increased demand will be permanent due to the increased count of datacenters that will eventually want to replace their obsolete, worn out hardware.

There might eventually be a larger supply of used RAM on the market, but a lot of it might not be compatible with mid-shelf consumer grade motherboards.

and grass is made of air

that’s why cows fart so much - cows are made of air

Bad console ports on PC where mouse control code was recycled from gamepad control code. For example, in Just Cause 2, the maximum turn rate is capped and so is the minimum cursor acceleration, with the end result being when you move the mouse your character moves like you’ve mushed a gamepad control stick instead of the fast, smooth, PC cursor style movement of the reticle that every other PC FPS manages to pull off.

And timed, text heavy games on mobile generally.

Squinting at you, Hearthstone.

what, you don’t like the flavor Blue?

3·1 month ago

3·1 month agoI’ve never seen one. We’ve got on-demand water heaters that feed entire homes, but the electric versions are notorious for breaking a lot. The trend is toward heat pump hot water storage tanks that cool the air around them and put that heat into the water tank.

2·1 month ago

2·1 month agoThat line caught my eye too. Negative mass is the missing ingredient for building an Alcubierre warp drive.

Its been done - link goes to a PDF of the study: